Evolving Landscape of Mental Health Segment: Key Market Insights of the Latest Published Substance Use Disorders Report — Alcohol Use Disorder, Cocaine Use Disorder, Opioid Use Disorder, and Cannabis Use Disorder | DelveInsight

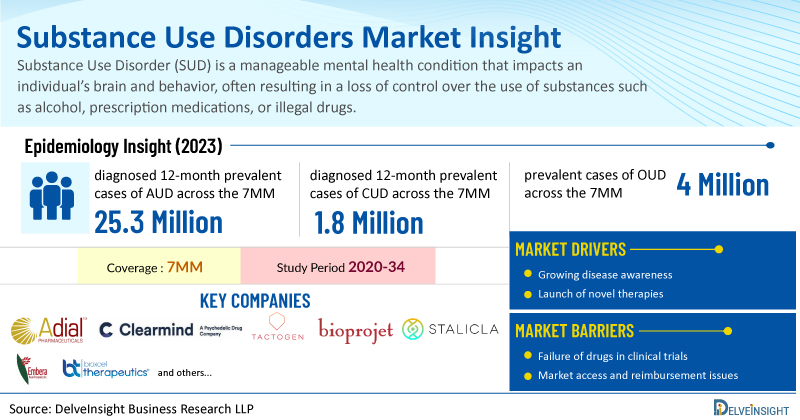

According to DelveInsight’s analysis, the market for substance use disorder is anticipated to increase during the forecast period (2025–2034), owing to increased awareness, a rise in the launch of emerging therapies, and extensive research and development.

/EIN News/ -- New York, USA, April 28, 2025 (GLOBE NEWSWIRE) -- Evolving Landscape of Mental Health Segment: Key Market Insights of the Latest Published Substance Use Disorders Report — Alcohol Use Disorder, Cocaine Use Disorder, Opioid Use Disorder, and Cannabis Use Disorder | DelveInsight

According to DelveInsight’s analysis, the market for substance use disorder is anticipated to increase during the forecast period (2025–2034), owing to increased awareness, a rise in the launch of emerging therapies, and extensive research and development.

Substance Use Disorder (SUD) is a manageable mental health condition that impacts an individual’s brain and behavior, often resulting in a loss of control over the use of substances such as alcohol, prescription medications, or illegal drugs. The severity of symptoms can range from moderate to extreme, with addiction representing the most intense form of the disorder.

Because SUD is a long-term condition prone to cycles of relapse and recovery, ongoing treatment is typically necessary. The primary treatment approaches include: Detoxification, Cognitive and behavioral therapies, and Medication-assisted treatments.

There are proven medications available to treat addictions to opioids, alcohol, and nicotine, and many also help manage symptoms of co-occurring mental health issues. Some medications may be effective across multiple conditions. The FDA has approved several drugs specifically for alcohol and opioid use disorders.

These medications work by stabilizing brain chemistry, reducing or blocking the pleasurable effects of substances, easing cravings, and helping restore normal physical and mental function, without inducing the euphoric high associated with substance use.

Additionally, several companies are currently working with their lead assets to improve the treatment landscape. DelveInsight’s analysis suggests that the substance use disorder market is expected to grow between 2025 and 2034, driven by greater awareness, the introduction of new therapies, and ongoing research and development efforts.

To gain a deeper understanding of the SUD market, be sure to explore the Substance Use Disorder Market Outlook

DelveInsight has expertise in the mental health market, and an experienced team handles the substance use disorders domain proficiently. DelveInsight has recently released a series of epidemiology-based market reports on substance use disorders, including Alcohol Use Disorder, Cocaine Use Disorder, Opioid Use Disorder, and Cannabis Use Disorder. These reports include a comprehensive understanding of current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Additionally, the reports feature an examination of prominent companies working with their lead candidates in different stages of clinical development. Let’s dive deeply into the market assessment of these substance use disorder types individually.

Alcohol Use Disorder (AUD) is a prevalent substance use condition marked by chronic, excessive, and uncontrollable alcohol consumption that affects an individual’s physical health, emotions, and social life. The severity of AUD can be classified as mild, moderate, or severe, depending on the number and intensity of symptoms. Individuals with AUD may exhibit signs of intoxication and withdrawal such as mood instability, impaired judgment, slurred speech, difficulty with memory or focus, poor coordination, sweating, a rapid heart rate, hand tremors, and in severe cases, seizures.

According to DelveInsight, there were an estimated 25.3 million diagnosed 12-month prevalent cases of AUD across the 7MM in 2023—a number projected to rise by 2034. Despite its widespread occurrence, treatment uptake remains low. Many with mild or moderate AUD may manage their drinking without professional help, whereas those with more severe or relapsing forms are more likely to seek medical intervention. The primary treatment objectives are either complete abstinence or a significant reduction in heavy drinking. Current treatment strategies include a combination of medication, behavioral therapy, detoxification, and psychosocial support through rehabilitation centers and peer support groups.

In the US, four FDA-approved medications are available for treating AUD: Acamprosate, Disulfiram (ANTABUSE), Oral Naltrexone (REVIA), and Extended-release Injectable Naltrexone (VIVITROL). Additionally, Topiramate (TOPAMAX) is recommended by the National Institute on Alcohol Abuse and Alcoholism. Internationally, Nalmefene (SELINCRO) is approved in Europe and Japan, while Baclofen (BACLOCUR) is approved in France, and Sodium Oxybate (SMO) in Italy.

A promising pipeline of investigational therapies is in development, including Adial Pharmaceuticals’ AD04 (ondansetron), Clearmind Medicine’s CMND-100, Tactogen’s TACT411/833, and Bioprojet’s BP1.3656, among others. These emerging treatments aim to fill existing gaps and have the potential to reshape the future of AUD management, offering hope for more effective and accessible care.

In 2023, the total alcohol use disorder market size across the 7MM was around USD 620 million, with the United States contributing approximately USD 475 million of that total. The anticipated rise in addiction prevalence within the 7MM, coupled with the expanding emerging pipeline, and the increasing involvement of generic manufacturers in supplying more affordable pharmaceuticals, are identified as the key drivers expected to propel the global AUD treatment market's growth over the forecast period (2024-2034).

Discover more about the AUD market in detail @ Alcohol Use Disorder Market Report

Cocaine Use Disorder (CUD) is a serious and debilitating condition with far-reaching effects on both individuals and society. Characterized by the compulsive use of cocaine despite its harmful medical, psychological, and behavioral impacts, CUD poses a major global public health challenge. According to DelveInsight, in 2023, there were 1.8 million diagnosed 12-month prevalent cases of CUD across the 7MM, with projections indicating steady growth through 2034 at a notable CAGR over the study period (2020–2034).

Current treatment strategies for CUD largely rely on psychosocial interventions, pharmacological therapies, and off-label drug use. Examples include antidepressants like citalopram (an SSRI), psychostimulants such as methadone and diacetylmorphine, dopamine agonists like amantadine and modafinil, dopamine blockers like Clozaril, and ketamine. Intensive patient therapy (IPT), involving multiple weekly sessions across individual, group, and family settings, has shown improved patient outcomes.

Common approaches also include group and individual drug counseling, with cognitive behavioral therapy (CBT) and motivational interviewing proving effective in preventing relapse. One of the most promising psychosocial methods is contingency management (CM), which uses voucher-based reinforcement therapy (VBRT) to incentivize recovery; patients receive vouchers for meeting specific therapeutic goals. Emerging treatments in the pipeline include investigational drugs like STP7 (STALICLA) and EMB-001 (Embera NeuroTherapeutics).

In 2023, the total market size for CUD in the 7MM stood at around USD 48.6 million. This figure is projected to grow substantially by 2034, fueled by the introduction of innovative therapies, improved healthcare access, and the increasing prevalence of the disorder. DelveInsight expects these factors to significantly drive demand for more effective treatment options over the coming years.

For a comprehensive view of the CUD market, check out the Cocaine Use Disorder Market Assessment

Opioid Use Disorder (OUD) is a chronic condition marked by ongoing opioid consumption that results in significant distress or impairment. Common symptoms include strong cravings, increased tolerance, and withdrawal effects when opioid use is stopped. It encompasses both physical dependence and addiction, potentially leading to serious outcomes such as disability or death. According to DelveInsight, there were an estimated 4 million prevalent cases of OUD across the 7MM in 2023, with the United States accounting for over half of these cases.

Treatment approaches typically include cognitive behavioral therapy aimed at building motivation for change, educating patients on treatment strategies, and preventing relapse. Support from peer groups like Narcotics Anonymous is also commonly part of the recovery process. Medications for opioid use disorder (MOUD) have proven effective in improving treatment adherence, reducing opioid consumption, minimizing overdose risk, and managing other OUD-related complications.

Pharmacological treatment often involves opioid substitution therapy using medications like buprenorphine or methadone to lower the risks of illness and death. Naltrexone is used to help prevent relapse, while naloxone serves as an emergency treatment for overdoses. Several approved drugs are currently available for OUD, including BRIXADI (Braeburn), SUBLOCADE (Indivior), and ZUBSOLV (Orexo), among others. Although many drugs in the pipeline are still in the early stages of development, market trends suggest a favorable shift is expected during the forecast period.

Some companies actively working on novel OUD treatments include BioXcel Therapeutics (BXCL501), Indivior (INDV-2000), and Go Medical Industries (GM0020/naltrexone implant), among others. In 2023, the U.S. held the largest share of the OUD market, valued at USD 1.4 billion. With several new therapies under investigation, the treatment landscape is expected to undergo considerable transformation between 2024 and 2034. However, the pace and extent of this change will largely depend on how regulatory challenges are navigated, which will ultimately shape the success and market impact of these emerging therapies.

Discover more about OUD drugs in development @ Opioid Use Disorder Clinical Trials

Cannabis, also known as marijuana, ranks as the third most widely used psychoactive substance globally, following alcohol and nicotine. It can be consumed in several ways, such as smoking, vaping, dabbing, eating, or applying topically as a cream. When cannabis use continues despite causing mental, physical, or social problems, it is referred to as Cannabis Use Disorder or cannabis abuse.

CUD affects around 10% of regular users and as many as 50% of those who use cannabis daily over long periods. Both cannabis use and CUD have been linked to a range of negative outcomes, including reduced cognitive function, difficulties in academic or work performance, impaired driving, increased emergency room visits, psychiatric issues, lower quality of life, use of other substances, and heightened risk of addiction or substance use disorders.

Cannabis Use Disorder treatment is gaining increasing attention as the growing acceptance of cannabis for medical and recreational purposes has brought the risks of misuse and dependency into focus. CUD is characterized by an individual’s inability to control cannabis use, often leading to significant impairments in various aspects of life, including health, social, and professional areas.

Treatment options typically include behavioral therapies, such as Cognitive Behavioral Therapy (CBT) and Contingency Management, aimed at helping individuals modify their drug-using behaviors. Despite its relatively low profile compared to other substance use disorders, research into pharmacological treatments for CUD is expanding. Drugs like cannabidiol (CBD) and certain opioid antagonists are under investigation to help reduce withdrawal symptoms and cravings. However, the effectiveness of these treatments is still under study, and no FDA-approved pharmacotherapy has yet been established.

The market dynamics surrounding cannabis use disorder treatment are evolving alongside the broader landscape of cannabis legalization and regulation. As more regions legalize cannabis for recreational and medical use, there is an increasing demand for evidence-based treatment options for those who develop dependency. This has spurred growth in the CUD treatment sector, attracting pharmaceutical companies, mental health providers, and even public health organizations to focus on solutions that address the unique challenges of cannabis misuse.

As awareness of the disorder grows, so does the market for support services such as addiction counseling, therapy centers, and digital health tools designed to help individuals manage cannabis use. However, challenges remain due to the stigma around cannabis use and the lack of universally accepted treatment protocols, which may slow the widespread adoption of available therapies. The future of CUD treatment will likely hinge on both further scientific research and the development of a more robust regulatory framework in the cannabis industry.

Explore in-depth for a comprehensive understanding of the Cannabis Use Disorder Clinical Trials

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

www.delveinsight.com

Distribution channels: Healthcare & Pharmaceuticals Industry, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release